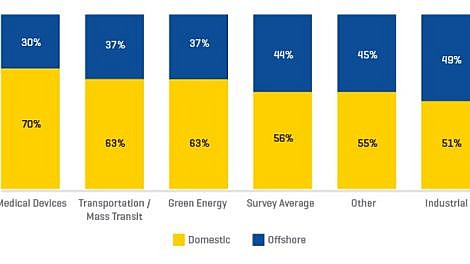

In this Plastics Industry Pulse, we’ll dive deeper into the data in the 2019-2020 Annual Survey and look at overseas plastics manufacturing and quality. As we covered in our Plastics Industry Pulse: Offshore Manufacturing, overseas plastics manufacturing tends to be underutilized by most industries. As a review, the survey data showed that overseas plastics is utilized less than half the time and tends to be a bit unpopular. Further, of those industries who have utilized overseas plastics, a majority of respondents said they either have already reversed course and re-shored operations domestically or they planned to do so in the future.

Plastics Industry Pulse: Offshore Plastics Trends examines the data that might explain just why offshoring plastics manufacturing is trending so negatively. It picks up where Offshore Manufacturing left off in describing the vast array of industry data sources surveyed.

In short, as more specialized industries grow in their need for high-quality plastics with exceptional aesthetic value, the offshore plastics trend will likely continue to trend toward negative values.

Offshore Plastics Trending Negatively & Need for Highest Quality Aesthetics

As industries such as green energy, medical device manufacturing, and transportation all continue to utilize plastics, their usage of domestic plastic manufacturing is likely to continue to increase. The data shows a correlation between industries such as these that demand higher aesthetics and higher quality and a negative correlation with utilizing offshore plastics.

Balancing the Need for Highest Quality with Less Costs

The survey data shows that industrials are the top segment currently utilizing offshore plastics manufacturing. While others, such as green energy, transportation and medical devices show a preference for domestic plastics.

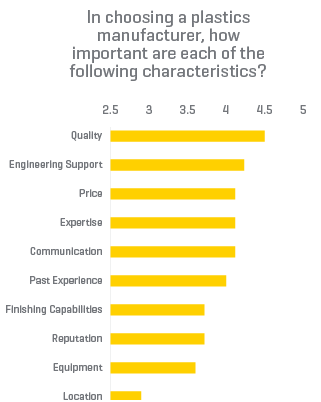

Following Chart 1.0 below, note that survey respondents chose “Quality” as their number one need when asked about their top priority in selecting a plastics manufacturer. This answer is consistent with data from past years’ surveys, as well.

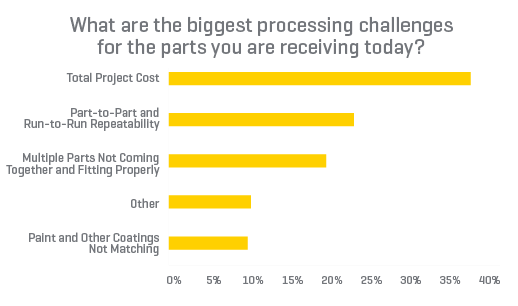

While respondents ranked “cost” (or “price”) as #3 in importance, when asked a slightly different way in a follow-up question, “total project cost” was ranked as the top processing challenge. The survey data demonstrates that off-shore plastics trends towards industry leaders seeking the highest quality at the lowest cost, particularly considering all of the dimensions of the total project cost. For example, in Chart 2.0 below, the next two items ranked as highest challenges include “part-to-part repeatability” and “multiple parts not coming together properly” which correlates with Chart 1.0: the need for quality translates into many different total project cost dimensions.

In the next Plastics Industry Pulse, we will take a look at what the data says about changes in process popularity, such as injection molding.

As always, we’re happy to share the report with you, and it’s absolutely free.

You can download it right here.